Some Ideas on "5 Reasons Why You Need a Budget Calculator" You Need To Know

Check it Out of Using a Digital Budget Calculator

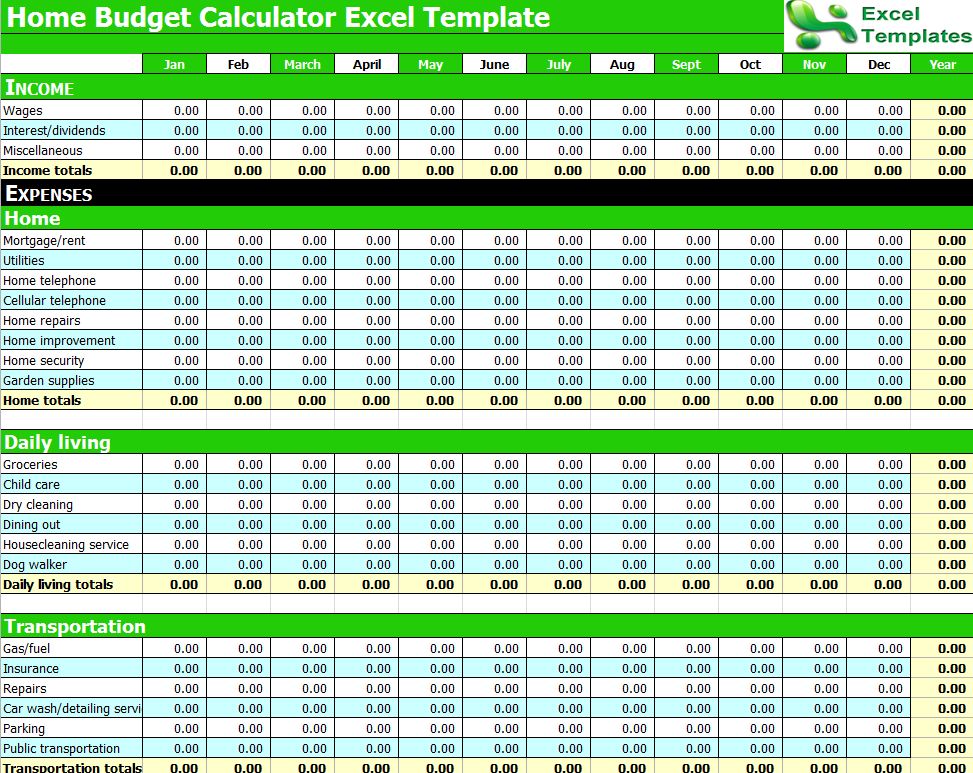

Managing financial resources may be a daunting activity for lots of people. Along with thus lots of expenses and costs to spend, it can be hard to always keep monitor of where your loan is going. Thankfully, there are tools available that can easily assist you take care of your finances even more efficiently, such as electronic budget personal digital assistants.

A electronic spending plan personal digital assistant is an on-line tool made to assist you maintain monitor of your profit and expenditures. It enables you to input your regular monthly earnings and expenditures and provides you with a break down of where your amount of money is going. There are several perks to using a digital spending plan personal digital assistant, featuring:

1. Improved Financial Awareness

One of the key perks of making use of a digital spending plan personal digital assistant is that it helps you come to be even more informed of your financial condition. By tracking your earnings and expenses, you'll have a far better understanding of how a lot money you're bringing in each month and how a lot you're spending on different categories such as real estate, transport, food items, enjoyment etc.

Having this relevant information conveniently accessible can aid you make much more informed financial selections in the future. For instance, if you discover that you're spending also a lot loan on dining out or enjoyment each month, you may decide to reduced back on those expenses until they line up much better along with your long-term monetary targets.

2. Increased Savings

Yet another advantage of utilizing a digital finances calculator is that it assists raise cost savings through identifying locations where expenses might be lessened or done away with altogether. Through tracking all cost in one area, the calculator may promptly determine locations where expense are much higher than expected or unneeded.

For circumstances, if the device reveals that an person devotes too a lot on groceries each month reviewed to their revenue degree or various other identical homes' costs patterns they might consider reducing this expense by shopping for groceries at lower-priced establishments or creating meal planning beforehand.

3. Much better Planning for Future Goals

Digital finances calculators also enable individuals to consider for potential objectives much more effectively by setting targets for savings at normal intervals. This feature may aid people track improvement toward their financial savings goals and adjust costs practices appropriately.

For instance, if an person's objective is to save $5,000 for a getaway in 12 months, the calculator can easily help them establish how a lot they require to save each month to accomplish that target. They can after that track their progress over opportunity and produce adjustments to their budget plan as important.

4. Minimized Financial obligation

Financial debt decline is another benefit of utilizing a electronic finances calculator. Through keep track of expenditures and revenue, these tools may aid consumers recognize places where they might be overspending or throwing away funds on unnecessary expenditures. This understanding can give useful relevant information for financial debt decline methods such as producing a financial obligation repayment program or merging financial obligations in to one account.

5. Improved Financial Security

Lastly, making use of a electronic budget plan calculator offers improved monetary surveillance through aiding consumers stay clear of overspending and living beyond their means. Through tracking expenses consistently, people can get better command over their finances and make certain that they are not spending even more than they get.

This raised monetary surveillance also enables people to save additional amount of money for emergencies or unexpected occasions such as work reduction or medical bills that need immediate attention.

Verdict

Digital budget calculators are highly effective devices that supply countless advantages for handling finances much more properly. They help enhance financial awareness, raise savings, much better plan for potential objectives like retired life or instructional backing necessities, lower financial debt concerns and improve general economic security.

Through utilizing these resources frequently in our day-to-day lives we might make far better private financing behaviors, which will eventually lead towards better decision-making capabilities when it comes to taking care of our financial resources skillfully. Therefore why not take benefit of this innovation today?